Understanding Your Business Credit Profile

Your business credit profile is more than just a snapshot of your financial health; it is a key asset that plays a significant role in your growth and opportunities. By managing your business credit profile effectively, you set the stage for future success, attracting new clients, partners, and investors who can propel your business forward.

The Fundamentals of a Strong Business Credit Profile

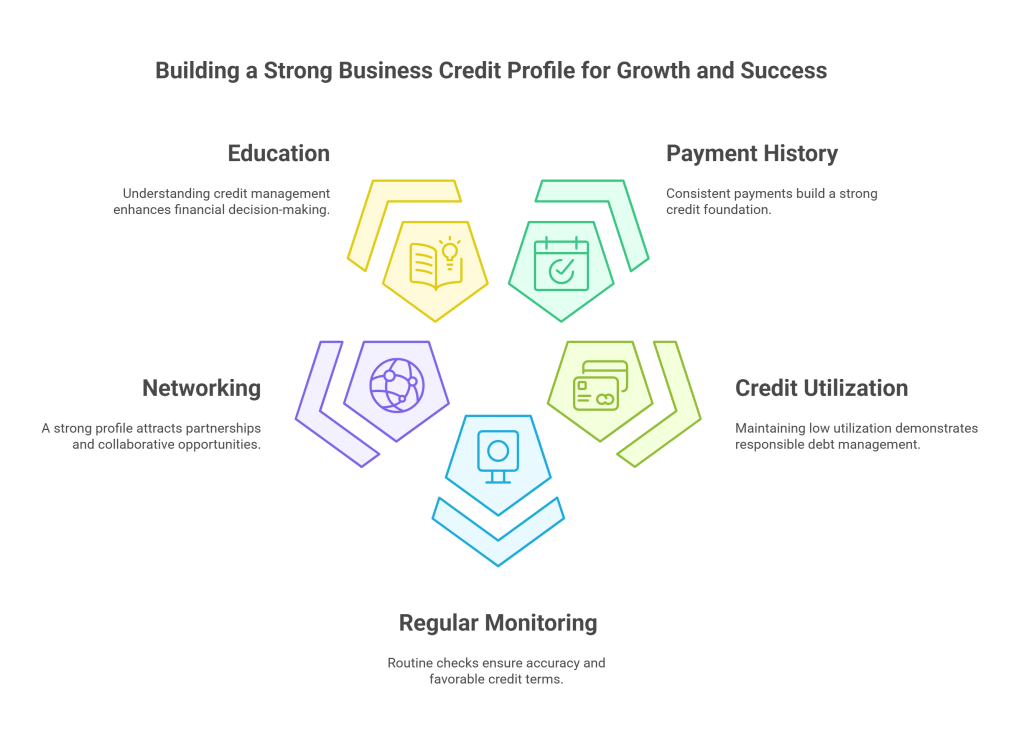

At its core, your business credit profile encompasses several critical elements that reflect your financial behavior. These include your payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries. Understanding these components will empower you to make informed decisions that enhance your creditworthiness.

Payment History

A consistent payment history is the backbone of a stout business credit profile. Lenders and creditors look to see if you meet your payment deadlines. Late payments or defaults can have a lasting impact on your credit score, so it is essential to establish a routine of making payments on time. Consider setting reminders or using automated payment systems to help manage this process effectively.

Credit Utilization

Your credit utilization ratio, the amount of credit you are using compared to your total available credit, is another crucial factor. Striving to maintain a low utilization rate, ideally below thirty percent, signals to lenders that you can manage debt responsibly. If your utilization begins to rise, think about strategies to decrease it, such as paying down outstanding balances or increasing your credit limits.

Regular Monitoring and Review

Just as you would keep an eye on your personal credit score, regularly reviewing your business credit profile is vital. Routine checks can help you identify inaccuracies that may misrepresent your financial standing. Errors in your credit report can hinder your ability to obtain funding or lead to unfavorable terms on loans. If you discover any discrepancies, take prompt action to dispute the inaccuracies with the relevant credit reporting agencies, ensuring that your business credit profile accurately reflects your financial behavior.

Networking Through Creditworthiness

Establishing a strong business credit profile not only opens the door to funding opportunities but also enhances your business’s reputation in the marketplace. A healthy credit profile can attract potential partners who recognize your reliability and financial responsibility. These partnerships can lead to collaborative opportunities, including joint ventures and co-marketing initiatives, fostering an innovative environment vital for growth.

Building Meaningful Connections

Networking is an integral part of business, and a strong credit profile can enhance your connections within your industry. When other businesses view you as a credible partner, they are more likely to consider collaborations that can amplify your reach and impact. These relationships can create valuable synergies, allowing you to leverage shared resources and insights for mutual benefit.

The Value of Education in Business Credit Management

As you navigate the complexities of business finance, investing in your education regarding credit management can yield significant rewards. Understanding your business credit profile empowers you to take decisive actions that enhance your financial standing. Participate in workshops and webinars or seek mentorship from seasoned entrepreneurs who can offer guidance tailored to your unique needs. This proactive approach to learning will enrich your understanding and equip you with the knowledge to navigate potential challenges effectively.

Strategies for Strengthening Your Business Credit Profile

Building a robust business credit profile is a multifaceted endeavor that requires diligence and strategic planning. Here are several strategies that can help strengthen your creditworthiness:

Diversify Your Credit Accounts

Diversifying your credit accounts can positively influence your credit profile. Different types of credit, such as loans and credit lines, demonstrate your ability to manage various forms of debt. By responsibly leveraging these accounts, you enhance your credit mix, which can boost your credit score over time.

Nurture Relationships with Creditors

Establishing and maintaining positive relationships with your creditors can also benefit your business credit profile. Open lines of communication can secure favorable terms and conditions. Proactively discussing your financial needs and goals with your creditors can pave the way for better partnership opportunities that enhance your business potential.

Consistent Payment Practices

Making timely payments is a fundamental principle of effective credit management. Create a structured payment plan that aligns with your cash flow to ensure you meet your financial obligations consistently. This practice not only reflects positively on your credit profile but also builds trust with your creditors.

Embracing the Path to Growth

In conclusion, actively managing your business credit profile is not just necessary; it is a foundational aspect of your entrepreneurial journey. By focusing on diverse credit accounts, nurturing creditor relationships, ensuring timely payments, and proactively monitoring your credit reports, you set your business up for long-term success.

Payment History

A consistent payment history is the backbone of a stout business credit profile. Lenders and creditors look to see if you meet your payment deadlines. Late payments or defaults can have a lasting impact on your credit score, so it is essential to establish a routine of making payments on time. Consider setting reminders or using automated payment systems to help manage this process effectively.

Credit Utilization

Your credit utilization ratio, the amount of credit you are using compared to your total available credit, is another crucial factor. Striving to maintain a low utilization rate, ideally below thirty percent, signals to lenders that you can manage debt responsibly. If your utilization begins to rise, think about strategies to decrease it, such as paying down outstanding balances or increasing your credit limits.

Regular Monitoring and Review

Just as you would keep an eye on your personal credit score, regularly reviewing your business credit profile is vital. Routine checks can help you identify inaccuracies that may misrepresent your financial standing. Errors in your credit report can hinder your ability to obtain funding or lead to unfavorable terms on loans. If you discover any discrepancies, take prompt action to dispute the inaccuracies with the relevant credit reporting agencies, ensuring that your business credit profile accurately reflects your financial behavior.

Networking Through Creditworthiness

Establishing a strong business credit profile not only opens the door to funding opportunities but also enhances your business’s reputation in the marketplace. A healthy credit profile can attract potential partners who recognize your reliability and financial responsibility. These partnerships can lead to collaborative opportunities, including joint ventures and co-marketing initiatives, fostering an innovative environment vital for growth.

Building Meaningful Connections

Networking is an integral part of business, and a strong credit profile can enhance your connections within your industry. When other businesses view you as a credible partner, they are more likely to consider collaborations that can amplify your reach and impact. These relationships can create valuable synergies, allowing you to leverage shared resources and insights for mutual benefit.

The Value of Education in Business Credit Management

As you navigate the complexities of business finance, investing in your education regarding credit management can yield significant rewards. Understanding your business credit profile empowers you to take decisive actions that enhance your financial standing. Participate in workshops and webinars or seek mentorship from seasoned entrepreneurs who can offer guidance tailored to your unique needs. This proactive approach to learning will enrich your understanding and equip you with the knowledge to navigate potential challenges effectively.

Strategies for Strengthening Your Business Credit Profile

Building a robust business credit profile is a multifaceted endeavor that requires diligence and strategic planning. Here are several strategies that can help strengthen your creditworthiness:

Diversify Your Credit Accounts

Diversifying your credit accounts can positively influence your credit profile. Different types of credit, such as loans and credit lines, demonstrate your ability to manage various forms of debt. By responsibly leveraging these accounts, you enhance your credit mix, which can boost your credit score over time.

Nurture Relationships with Creditors

Establishing and maintaining positive relationships with your creditors can also benefit your business credit profile. Open lines of communication can secure favorable terms and conditions. Proactively discussing your financial needs and goals with your creditors can pave the way for better partnership opportunities that enhance your business potential.

Consistent Payment Practices

Making timely payments is a fundamental principle of effective credit management. Create a structured payment plan that aligns with your cash flow to ensure you meet your financial obligations consistently. This practice not only reflects positively on your credit profile but also builds trust with your creditors.

Embracing the Path to Growth

In conclusion, actively managing your business credit profile is not just necessary; it is a foundational aspect of your entrepreneurial journey. By focusing on diverse credit accounts, nurturing creditor relationships, ensuring timely payments, and proactively monitoring your credit reports, you set your business up for long-term success.